Alcohol producers and other business leaders are understandably a bit nervous about the state of the economy at present. We’re all still a bit shell-shocked from the alarming and extreme recession at the beginning of the pandemic.

Having the right information is key to making effective business decisions, so let’s explore the state of the economy right now and its potential effects for business owners in the alcohol industry.

Table of Contents

Recessions & the Economy

What Is a Recession?

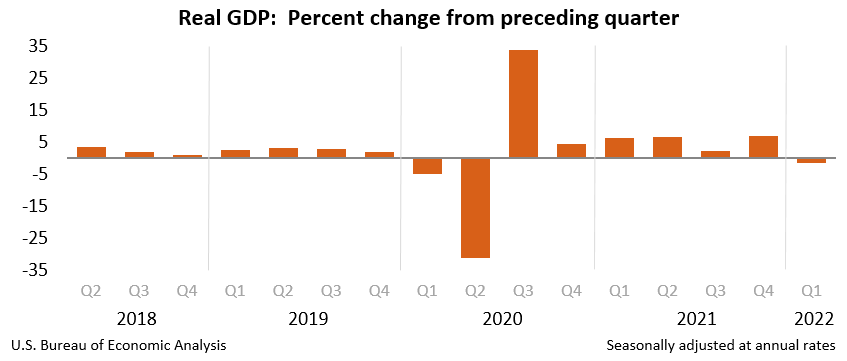

There are many different ways to define a recession. One common definition is two consecutive financial quarters of negative gross domestic product (GDP). But the folks who decide when our economy is in a recession, the National Bureau of Economic Research, consider many factors when evaluating the state of the economy, including the unemployment rate. The NBER tracks the state of the economy, and due to the fact that many economic indicators are lagging, they often only declare a recession after the recession is already over.

Are We in a Recession Right Now?

For all of the reasons we’ve discussed, it’s difficult to say whether we are currently experiencing a recession. If you define a recession simply as two consecutive quarters of negative GDP, then we may currently be in a recession at the time of writing (August 2022). The U.S. economy reported a negative GDP for the first and second quarters of 2022. There is some debate on the value of GDP alone as a recession indicator, though, especially when paired with an increase in GDI (gross domestic income). Recessions are nearly always accompanied by increased rates of unemployment, and that’s not something we’re seeing right now. Last month, in July, the U.S. economy added 500,000 jobs, and unemployment is at just 3.5%, the lowest it’s been since February 2020.

How Is the Economy Currently?

As you might guess from our discussion so far, there is no straightforward, uncomplicated analysis of the state of the economy. We may or may not currently be in a recession; we may or may not experience a recession over the coming months. The benchmarks economists usually use to illustrate a trend towards growth or contraction are complicated by things like an unstable labor market, supply chain issues, and sky-high inflation.

We’d also point out that large-scale economic trends don’t always reflect the financial reality for American consumers. Record inflation has many Americans struggling to make ends meet. Though unemployment is low, wages haven’t kept up with rising costs, especially for long-term economic mobility measures like the cost of higher education. The rising cost of daily necessities is causing many people to cut back on their discretionary spending — which could spell trouble for alcohol producers over the coming months.

Potential Recession Impacts for Alcohol Producers

Is Beer Consumption Truly “Recession-Proof”?

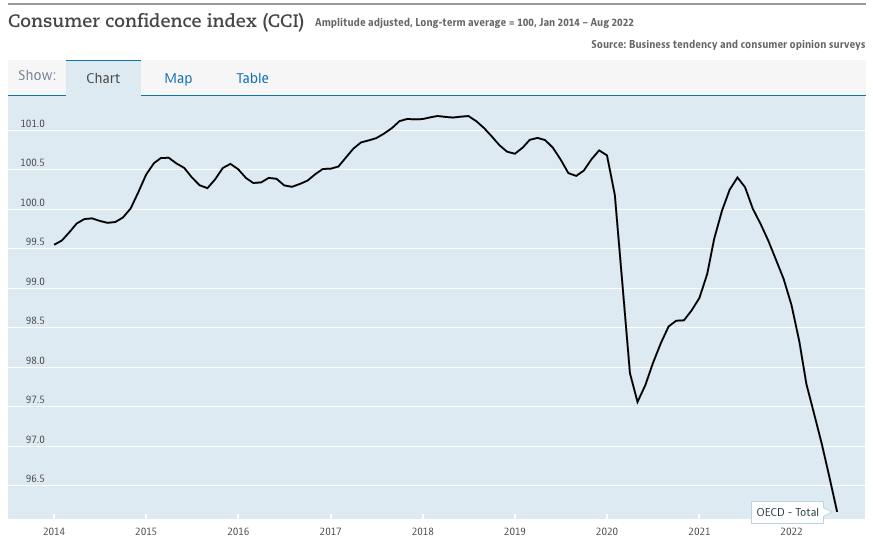

Co-operation and Development, Consumer Confidence Index

The conventional markers used to evaluate the economy don’t always reflect the reality for workers and consumers in that market. The current state of our economy is a great example of the limits of the usual techniques. Economists remain unsure of whether we’re currently in a recession, due to mixed signals from different aspects of the market, like GDP, GDI, and unemployment rates. But consumer confidence is extremely low right now — lower even than it was during the worst months of the pandemic in 2020. This data point comes closer to reflecting the economic reality for Americans; inflation is causing serious financial hardship for many people.

It’s important to understand the complexity of these factors because at the end of the day, for the alcohol industry, it’s consumer confidence and consumer discretionary spending that truly make the difference in sales.

How the Current Market Could Affect Breweries

Folks in our industry often say that beer sales are “recession-proof,” and with good reason. Beer is cheaper than other alcoholic beverages, and it’s also an important feature of socializing for many people, making consumers loath to give it up, even during times of financial difficulty.

It’s true that beer is one of the alcoholic beverages that is most resilient to economic fluctuation. But with many breweries forced to raise costs due to inflation, and consumers simultaneously cutting back on their discretionary spending, even beer producers could see modest drops in sales over the coming months.

It’s unlikely a coming drop in sales would be large enough to have severe business consequences, because beer remains one of the alcoholic beverages that is well-insulated from market fluctuations. What breweries may see, instead, is a shift in the way people consume. At-home consumption may increase as a more affordable option for people who want to cut back on their spending. Drinking in a brewery or taproom is more expensive (due to factors like gas and other transportation costs, tips, food, and the overall cost of draft beer) than buying beer in-store or ordering it online. Prepare for a potential uptick in demand for bottled or canned beer over beer on tap.

How the Current Market Could Affect Wineries

Wine may not be considered as recession-proof as beer, but it remains relatively safe from potential economic downturn. Most wine drinkers, especially those who collect fine wines, are on the older and wealthier side — they’re not as vulnerable to the financial strain of inflation as most people.

A recession or decline in sales could still spell trouble for wineries long-term. Wine producers need to attract younger buyers in order to ensure the health of the industry years down the line. That inflation is most seriously impacting young and low-income people may cause a decline in wine sales for those demographics as they prioritize daily necessities and pay off debts. Young people are also generally more interested in trendy beverages like cannabis-infused drinks and non-alcoholic or low ABV beverages.

Wineries might consider expanding their trendier sparkling options or improving affordability with new-customer discounts and incentives.

Preparing Your Business for a Recession

Be Ready for More At-Home Drinking

There’s a good chance wineries and breweries will see a modest drop in on-premise sales over the coming months. Breweries in particular should prepare to pivot to to-go sales and/or beef up retail distribution efforts. If your business operates in a state that allows it, prepare for a potential increase in direct-to-consumer sales of packaged goods by creating or improving your e-commerce presence.

Pricing Transparency

Consumers are weary of growing prices in every industry. But raising your prices may still be necessary to compensate for the increasing cost of labor and ingredients. If you do need to increase your prices, consider making an understated, transparent announcement to that effect on your website or social media. It doesn’t need to be a production — in fact, it really shouldn’t be. Just be honest with your customers about why the price increase is necessary. They may not be happy about it, but chances are they’ll understand, and honesty goes a long way.

Cut Costs Elsewhere

You may not need to raise your prices in order to maintain profit margins. You could promote the beers or wines that are least expensive to manufacture, which can increase profits without requiring an increase in sales. Use your brewery software to run COGS reports or other cost analyses to see which beverages are the most cost effective to produce, and divert your marketing efforts to focus on those areas. Promoting your most affordable beverages may also help to ease the sting of any price increases that may be necessary.

Strengthen Your Supply Chain

Now is a good time to strengthen distributor and retailer relationships. Consider trying to negotiate better prices from your vendors. It can’t hurt to reach out to new suppliers to connect, either.

Though supply chain issues have begun to ease in recent months, remember the recent keg and can shortages when planning your orders and working with vendors. An increase in bottle/can sales will require more packaging supplies, and many vendors have raised their minimum order quantities recently, making it difficult for craft producers to get the supplies they need. Consider looking for new suppliers if you’re not locked into a contract, and reach out to other producers to see if you can pool your resources to come up with creative packaging solutions.

No industry is fully recession-proof. Luckily, even if the economy is headed for a temporary downturn, the alcohol industry is resilient enough to survive and thrive. Use our strategies to prepare for a moderate decrease in sales and your business will be well positioned to make the most of changes to consumer spending habits.